Sporting goods retailer Academy Sports & Outdoor (NASDAQ:ASO) fell short of the markets revenue expectations in Q3 CY2025 as sales rose 3% year on year to $1.38 billion. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $6.11 billion at the midpoint. Its non-GAAP profit of $1.14 per share was 7.5% above analysts’ consensus estimates.

Is now the time to buy Academy Sports? Find out by accessing our full research report, it’s free for active Edge members.

Academy Sports (ASO) Q3 CY2025 Highlights:

- Revenue: $1.38 billion vs analyst estimates of $1.40 billion (3% year-on-year growth, 1.3% miss)

- Adjusted EPS: $1.14 vs analyst estimates of $1.06 (7.5% beat)

- Adjusted EBITDA: $141.5 million vs analyst estimates of $136.4 million (10.2% margin, 3.8% beat)

- The company reconfirmed its revenue guidance for the full year of $6.11 billion at the midpoint

- Management lowered its full-year Adjusted EPS guidance to $5.90 at the midpoint, a 0.8% decrease

- Operating Margin: 7.3%, in line with the same quarter last year

- Free Cash Flow was -$9.11 million, down from $34.45 million in the same quarter last year

- Locations: 317 at quarter end, up from 293 in the same quarter last year

- Same-Store Sales were flat year on year (-4.9% in the same quarter last year)

- Market Capitalization: $3.25 billion

"We continue to see an acceleration in our underlying growth strategies, despite the uncertain economic backdrop the consumer is facing," said Steve Lawrence, Chief Executive Officer.

Company Overview

Founded in 1938 as a tire shop before expanding into fishing equipment, Academy Sports & Outdoor (NASDAQ:ASO) sells a broad selection of sporting goods but is still known for its outdoor activity merchandise.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $6.01 billion in revenue over the past 12 months, Academy Sports is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

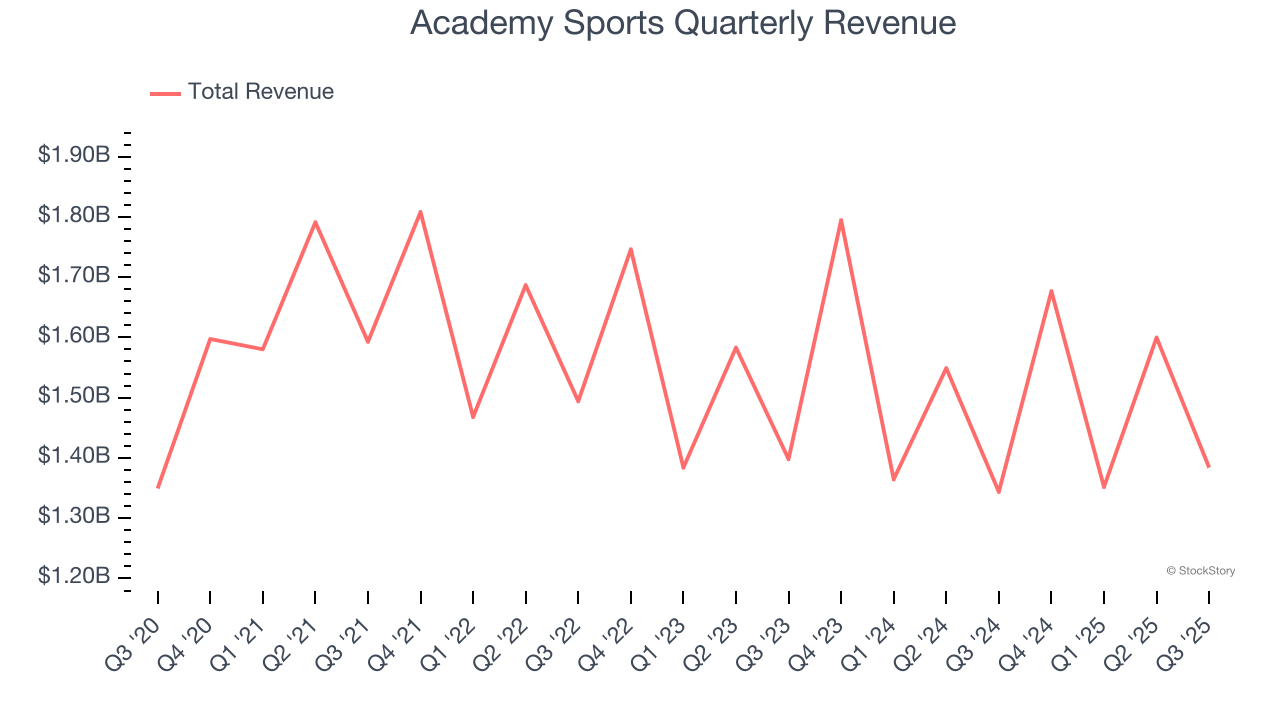

As you can see below, Academy Sports’s revenue declined by 2.4% per year over the last three years (we compare to 2019 to normalize for COVID-19 impacts) despite opening new stores. This implies its underperformance was driven by lower sales at existing, established locations.

This quarter, Academy Sports’s revenue grew by 3% year on year to $1.38 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.5% over the next 12 months, an acceleration versus the last three years. This projection is commendable and implies its newer products will fuel better top-line performance.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Store Performance

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

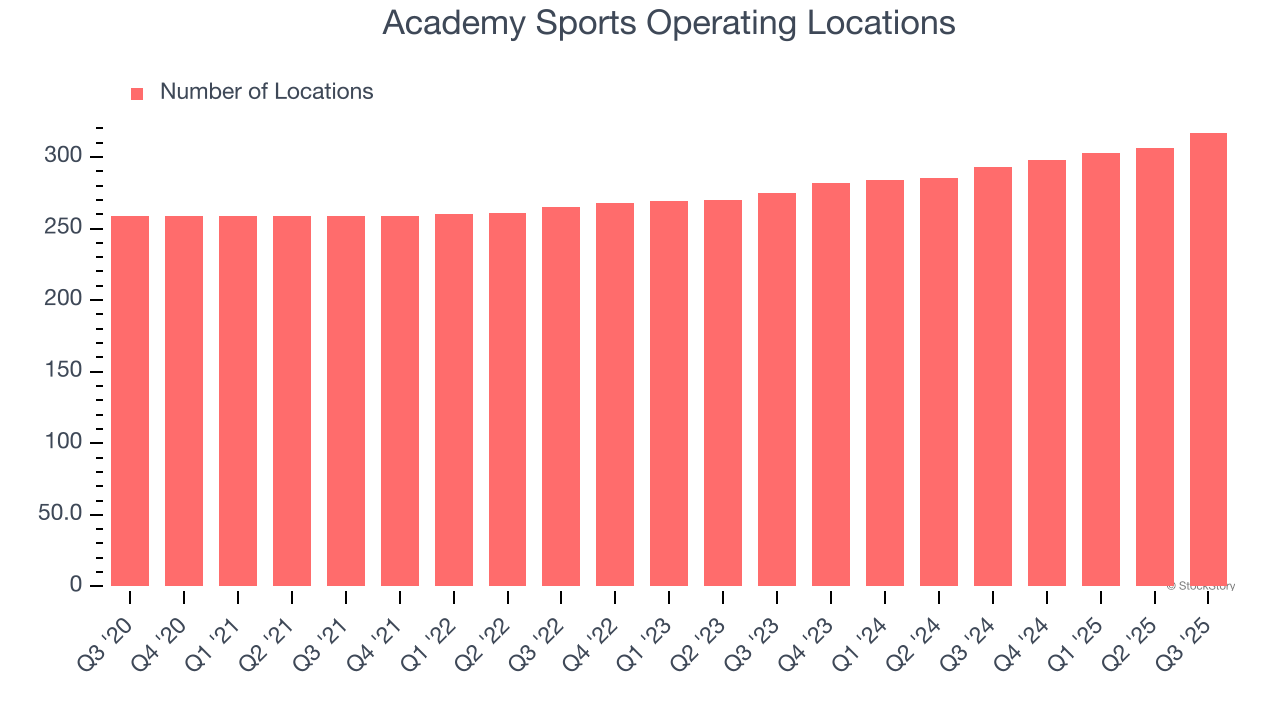

Academy Sports sported 317 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip by averaging 6.4% annual growth, among the fastest in the consumer retail sector. This gives it a chance to become a large, scaled business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

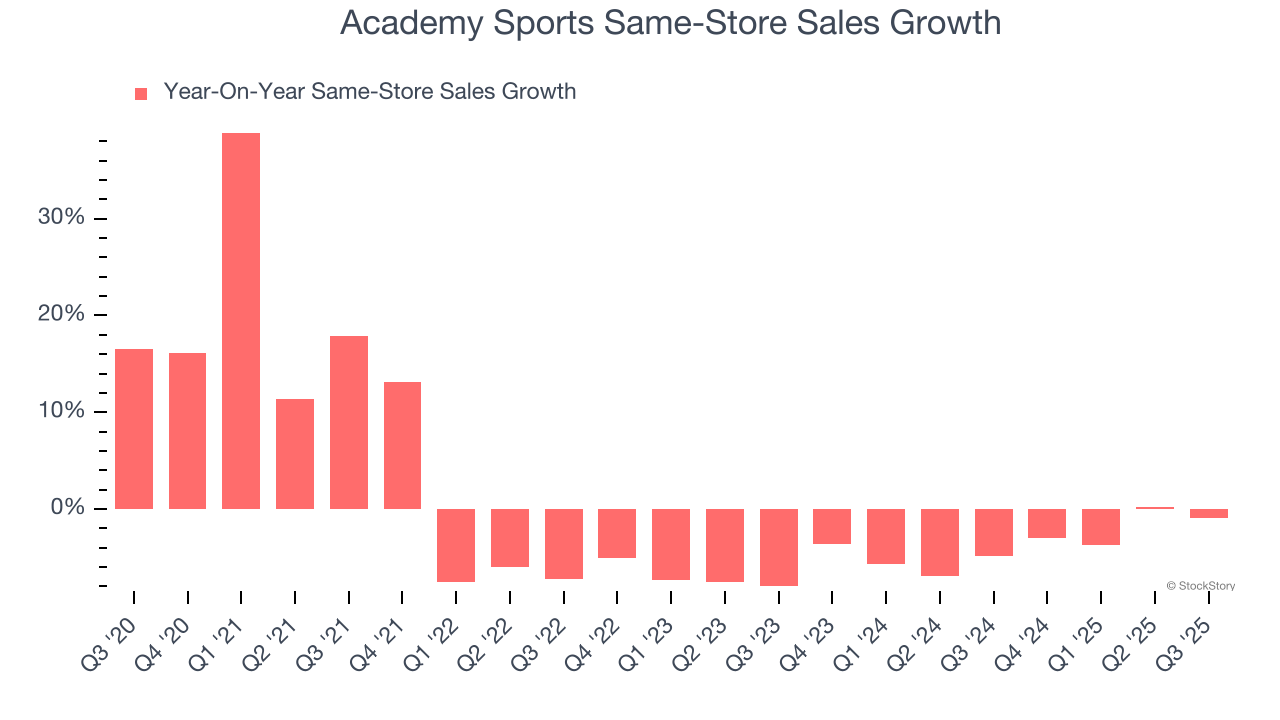

Academy Sports’s demand has been shrinking over the last two years as its same-store sales have averaged 3.6% annual declines. This performance is concerning - it shows Academy Sports artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

In the latest quarter, Academy Sports’s year on year same-store sales were flat. This performance was a well-appreciated turnaround from its historical levels, showing the business is improving.

Key Takeaways from Academy Sports’s Q3 Results

We enjoyed seeing Academy Sports beat analysts’ gross margin expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its revenue slightly missed. Overall, this print had some key positives. The stock remained flat at $48.77 immediately after reporting.

Is Academy Sports an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.