Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Coinbase (NASDAQ:COIN) and the best and worst performers in the consumer internet industry.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 47 consumer internet stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 2.1% while next quarter’s revenue guidance was in line.

While some consumer internet stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.1% since the latest earnings results.

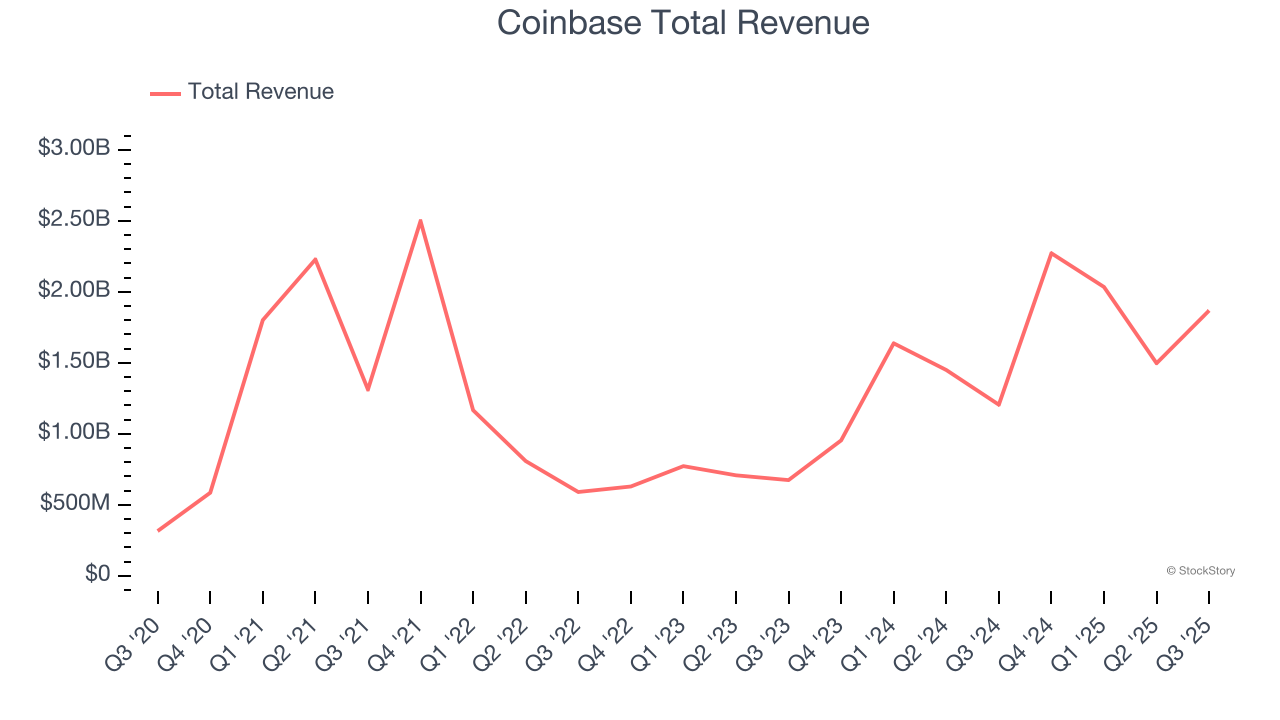

Coinbase (NASDAQ:COIN)

Widely regarded as the face of crypto, Coinbase (NASDAQ:COIN) is a blockchain infrastructure company updating the financial system with its trading, staking, stablecoin, and other payment solutions.

Coinbase reported revenues of $1.87 billion, up 55.1% year on year. This print exceeded analysts’ expectations by 4.5%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ revenue estimates.

Unsurprisingly, the stock is down 16.4% since reporting and currently trades at $274.15.

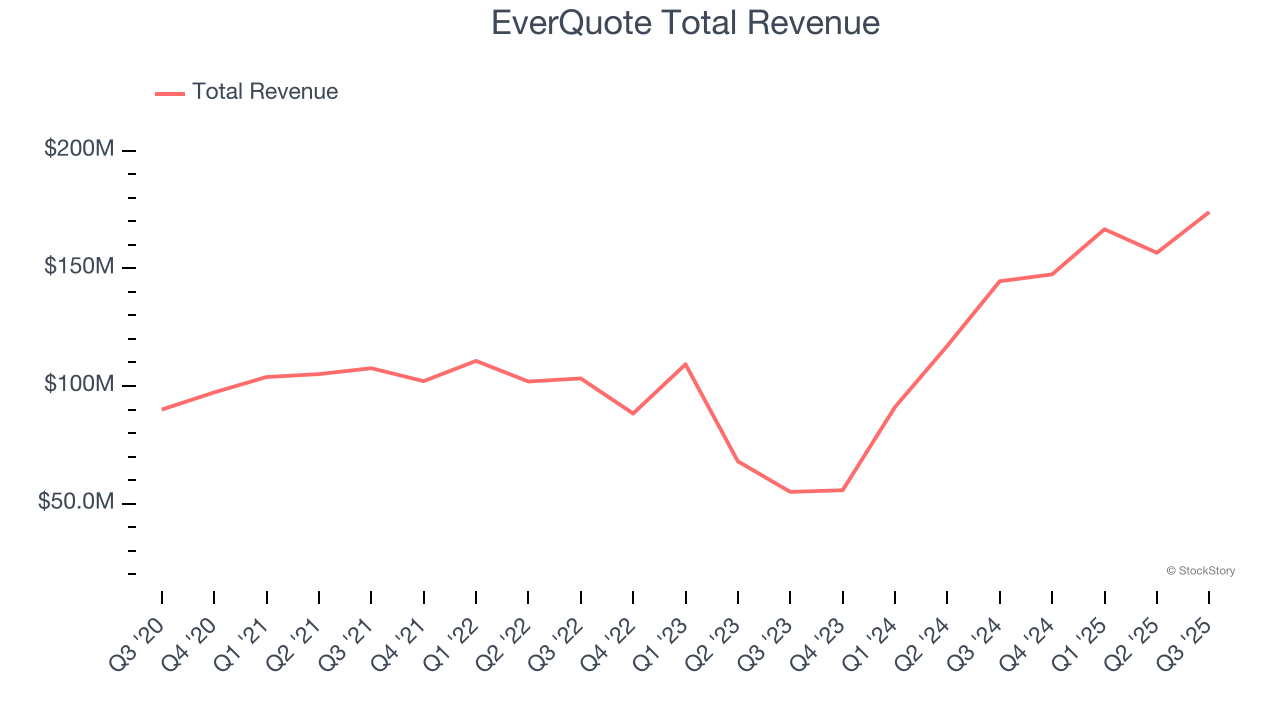

Best Q3: EverQuote (NASDAQ:EVER)

Aiming to simplify a once complicated process, EverQuote (NASDAQ:EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

EverQuote reported revenues of $173.9 million, up 20.3% year on year, outperforming analysts’ expectations by 4.3%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates and revenue guidance for next quarter exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 19.2% since reporting. It currently trades at $26.72.

Is now the time to buy EverQuote? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: ACV Auctions (NYSE:ACVA)

Founded in 2014, ACV Auctions (NASDAQ:ACVA) is an online auction marketplace for car dealers and wholesalers to buy and sell used cars.

ACV Auctions reported revenues of $199.6 million, up 16.5% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted full-year revenue guidance slightly missing analysts’ expectations and full-year EBITDA guidance missing analysts’ expectations significantly.

The stock is flat since the results and currently trades at $8.12.

Read our full analysis of ACV Auctions’s results here.

CarGurus (NASDAQ:CARG)

Bringing transparency to a sometimes opaque process, CarGurus (NASDAQ:CARG) is a digital marketplace where auto dealers can connect with potential customers and where car buyers can browse, purchase, and obtain financing.

CarGurus reported revenues of $238.7 million, up 3.2% year on year. This number topped analysts’ expectations by 1.6%. Overall, it was a strong quarter as it also produced EBITDA guidance for next quarter topping analysts’ expectations and a decent beat of analysts’ EBITDA estimates.

The company reported 33,673 users, up 6.3% year on year. The stock is up 6.9% since reporting and currently trades at $35.42.

Read our full, actionable report on CarGurus here, it’s free for active Edge members.

eHealth (NASDAQ:EHTH)

Aiming to address a high-stakes and often confusing decision, eHealth (NASDAQ:EHTH) guides consumers through health insurance enrollment and related topics.

eHealth reported revenues of $53.87 million, down 7.8% year on year. This print surpassed analysts’ expectations by 4.2%. It was a very strong quarter as it also logged a solid beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

The company reported 1.12 million users, down 3.5% year on year. The stock is down 25.7% since reporting and currently trades at $3.67.

Read our full, actionable report on eHealth here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.