Interactive Brokers Group, Inc. - Class A Common Stock (IBKR)

77.58

+0.37 (0.48%)

NASDAQ · Last Trade: Jan 25th, 11:35 AM EST

The stock has averaged annual gains of more than 50% over the past three years.

Via The Motley Fool · January 25, 2026

The Charles Schwab Corporation (NYSE: SCHW) has ushered in the 2026 fiscal year by shattering internal records, reporting a massive $11.9 trillion in total client assets and a record-breaking fourth-quarter revenue of $6.34 billion. The results, released on January 21, 2026, underscore a significant milestone for the brokerage

Via MarketMinute · January 23, 2026

As we move into early 2026, the global information landscape has undergone a radical transformation. No longer are political analysts and corporate strategists solely reliant on slow-moving surveys or expert panels to gauge the future. Instead, they are turning to the real-time, high-stakes data of prediction markets. These platforms, once viewed as niche betting hubs, [...]

Via PredictStreet · January 23, 2026

In the early hours of January 3, 2026, the world woke to the shocking news that Nicolás Maduro had been captured by U.S. Special Operations forces in a daring raid dubbed "Operation Absolute Resolve." But while mainstream news outlets like The New York Times (NYSE: NYT) and News Corp (NASDAQ: NWSA) were scrambling to confirm [...]

Via PredictStreet · January 23, 2026

As the first month of 2026 draws to a close, the prediction market industry is no longer a niche corner of the internet; it has evolved into a foundational pillar of global finance. On Manifold Markets, a high-stakes meta-contract titled "Top 1 Prediction Market by Volume in 2026" has become the definitive barometer for the [...]

Via PredictStreet · January 23, 2026

As the 2026 midterm election cycle enters its first high-stakes primary season this January, the prediction market landscape looks radically different than it did during the 2024 presidential frenzy. While the crypto-fueled giants like Polymarket continue to draw billions in volume from international speculators, a quieter, more academic battle is being waged on PredictIt. Despite [...]

Via PredictStreet · January 23, 2026

The sudden $400,000 profit on a Venezuelan regime-change contract has done more than just mint a new crypto-millionaire; it has ignited a firestorm on Capitol Hill. As of January 23, 2026, the prediction market industry is facing its most significant regulatory reckoning to date with the introduction of the "Public Integrity in Financial Prediction Markets [...]

Via PredictStreet · January 23, 2026

On January 12, 2026, the global financial landscape reached a watershed moment that many analysts are calling the "death of the pundit and the birth of the market." Total daily trading volume across prediction platforms skyrocketed to a record-breaking $701.7 million, shattering the previous day's record and signaling a fundamental shift in how the world [...]

Via PredictStreet · January 23, 2026

Via Benzinga · January 23, 2026

Interactive Brokers, one of IBD's 2026 10 Best Online Brokers, wins customers with innovation, mobile apps and research tools.

Via Investor's Business Daily · January 23, 2026

The stocks in this article are all trading near their 52-week highs.

This strength often reflects positive developments such as new product launches, favorable industry trends, or improved financial performance.

Via StockStory · January 22, 2026

In a transformative move that blurs the lines between decentralized finance and Wall Street, Coinbase Global, Inc. (NASDAQ: COIN) has officially completed the rollout of its new "Everything Exchange" ecosystem. As of January 2026, the platform now offers commission-free U.S.-listed stock trading and fully integrated prediction markets to

Via MarketMinute · January 22, 2026

As of January 22, 2026, the global financial landscape is undergoing a fundamental transformation. What was once a niche corner of the internet for political junkies and hobbyist forecasters has evolved into a powerhouse of the modern economy. Prediction markets—increasingly rebranded by Wall Street as "event trading"—are no longer just a curiosity; they are becoming [...]

Via PredictStreet · January 22, 2026

As the Federal Reserve prepares for its first policy meeting of 2026 on January 28, a quiet revolution is taking place on the trading floors of Manhattan and Chicago. While traditional bond traders scramble to interpret yield curve shifts, a growing cohort of institutional and retail investors is turning to Kalshi to buy direct protection [...]

Via PredictStreet · January 22, 2026

In the wake of the high-stakes 2024 election cycle, many analysts expected a "prediction market hangover"—a period of cooling interest and declining volumes as the political fever broke. Instead, as of January 22, 2026, the opposite has occurred. Prediction markets have evolved from election-centric novelties into high-velocity "truth engines" for every corner of culture and [...]

Via PredictStreet · January 22, 2026

As of January 22, 2026, the landscape of American finance is undergoing its most radical transformation in decades, driven not by a new asset class, but by the systematic dismantling of the guardrails that once hemmed it in. The Commodity Futures Trading Commission (CFTC), once the primary antagonist of event-based wagering, has been effectively reshaped [...]

Via PredictStreet · January 22, 2026

As we cross into 2026, the global information landscape has undergone a radical transformation. The era of relying solely on traditional polling—often criticized for its slow response times and methodological lag—is being eclipsed by the rise of prediction markets. Following their standout performance during the 2024 US Presidential Election, these platforms are no longer viewed [...]

Via PredictStreet · January 22, 2026

NEW YORK — Polymarket, the world’s largest decentralized prediction platform, has officially begun its long-awaited homecoming. After years of operating in a regulatory exile that forced it to block American IP addresses, the platform is now aggressively onboarding thousands of users from its domestic waitlist. This strategic pivot follows a landmark regulatory shift under the [...]

Via PredictStreet · January 22, 2026

Via Benzinga · January 22, 2026

These stocks offer impressive long-term upside with downside protection.

Via The Motley Fool · January 22, 2026

The online broker continues to add new customer accounts at an extraordinary rate.

Via The Motley Fool · January 21, 2026

On January 21, 2026, Charles Schwab (NYSE: SCHW) reported record-breaking financial results for the fourth quarter of 2025, marking a definitive conclusion to its multi-year integration of TD Ameritrade and signaling a shift toward aggressive innovation. The firm posted a GAAP net income of $2.5 billion, or $1.33

Via MarketMinute · January 21, 2026

Curious about which S&P500 stocks are generating unusual volume on Wednesday? Find out below.chartmill.com

Via Chartmill · January 21, 2026

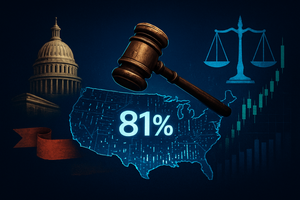

As the legal landscape for prediction markets enters its most volatile phase yet, a "Shadow Market" on the forecasting platform Manifold Markets has become the ultimate barometer for the industry's survival. Traders are currently placing an overwhelming 81% probability on a scenario where federal preemption—the legal doctrine that federal law overrides state law—will shield prediction [...]

Via PredictStreet · January 21, 2026

As the 2026 legislative session kicks off in Albany, the future of the prediction market industry in the United States is being decided not in a courtroom or on a trading floor, but in the halls of the New York State Assembly. The Oversight and Regulation of Activity for Contracts Linked to Events (ORACLE) Act, [...]

Via PredictStreet · January 21, 2026